Remote Deposit Capture/Merchant Source Capture Quick Reference Guide

Customer Support

410-766-3300

Monday – Friday: 8:00 AM – 4:00 PM

Bank on your schedule, not ours.

Remote Deposit Capture offers business customers a cost-effective way to deposit checks 24 hours a day, 7 days a week. Optimize your business cash flow and make deposits right from your office into your BOGB checking account any time of day without making a trip to the bank. Businesses scan checks received from customers using a web-based desktop scanner and PC. Once scanned, users transmit the scanned check images over a secure internet connection to The Bank of Glen Burnie for posting and clearing.

Remote Deposit Capture offers business customers a cost-effective way to deposit checks 24 hours a day, 7 days a week. Optimize your business cash flow and make deposits right from your office into your BOGB checking account any time of day without making a trip to the bank. Businesses scan checks received from customers using a web-based desktop scanner and PC. Once scanned, users transmit the scanned check images over a secure internet connection to The Bank of Glen Burnie for posting and clearing.

Advantages of Remote Deposit Capture

- Streamline cash flow by consolidating deposits from multiple locations into a single financial institution

- Make deposits 24/7

- Save time preparing deposits

- Reduce time and costs spent on courier fees or trips to your local branch

- Reduce risk of fraud

- Great for businesses with multiple locations and those who have a large number of check payments each month or checks with large dollar amounts

- Make deposits after business hours

- Improve staffing levels

Getting Started

Workstation and Scanner Requirements

Please review all Remote Deposit Capture Workstation and Scanner Requirements.

Scanner Maintenance

Clean your scanner as advised by the manufacturer. If you run high volumes, we suggest cleaning daily.

Panini Scanner Cleaning Instructional Video

Log On to Remote Deposit Capture

- Use The Bank of Glen Burnie’s website (www.thebankofglenburnie.com) to access Remote Deposit Capture/Merchant Source Capture.

- Click on the blue Online Banking button in the upper right corner of the website and log in to Business Online Banking.

- Enter your Username and Password.

- Answer any security questions required to complete the log in process.

- Once logged in, select Checks & Deposits.

- Click the Deposit Checks button.

- Follow the instructions below to create a deposit.

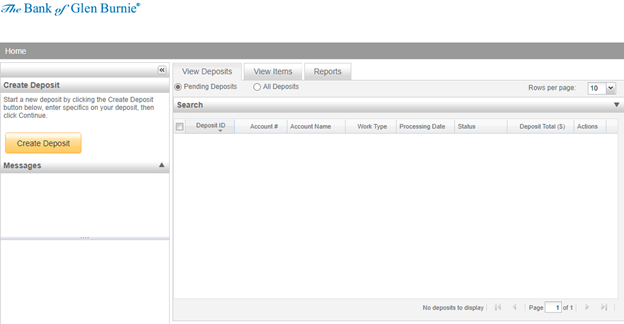

Creating a Deposit

- Click on the yellow Create Deposit button in the upper left corner.

2. A new window will open. Enter the following information when creating a deposit:

- Deposit Name – Enter a name for the deposit.

- Enter Deposit Amount – Enter the amount of the total deposit. Zeros automatically populate as cents. (For example, if you enter an amount of 5000, this populates as 50.00.)

- Select Account – Select the account for which the deposit is being created. The selected account will be highlighted.

- Store Number (optional) – Enter a store number or location number, if desired.

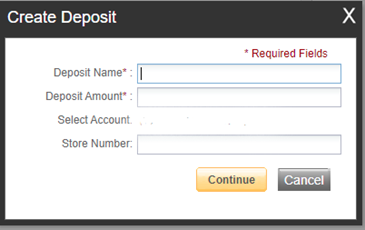

3. Click Continue and a Scan Screen will appear.

(Note your Deposit ID number on something to attach to the front of your deposit after scanning. This is helpful if you need to refer back to the deposit.)

Scanning Work

Please keep deposits to fewer than 200 items at a time. Place checks in the scanner hopper as shown below.

Prepare Checks for Deposit

-

Place checks in the scanner hopper as shown.

Remove all tape, staples, and paper clips. Check items for folded corners. Stamp all checks in the endorsement area with the BOGB-provided stamp indicating the deposit is being processed by remote capture.

- Make sure checks are straightened and tidy and jog and fan checks thoroughly before placing them in the scanner hopper. Ensure all documents are facing the same direction and not upside down. This will reduce rejects, jams, double documents, and piggybacks and maximize image quality.

- When items scan crooked, check all fields to verify information scanned correctly.

- If more than one person is using the device, make sure there are no out-of-balance batches prior to beginning a new capture.

- Always make sure Detect Double-Feed is selected before proceeding to scan items. This will ensure any duplicated items scanned will be detected.

- The scanning device may have trouble reading:

- Items written in ink other than black

- Checks written lightly or illegibly

- Checks which have been folded, creased, or mutilated

- Click the Scan button at the bottom of the screen.

- Click Continue Scanning this Deposit in the User Actions box if you have to remove your items from the scanner.

- Monitor the Items Scanned and Items Processed counters at the bottom of the screen. If Items Processed falls behind by over 50 items, click Stop Scan on the Scan Navigator.

- When Items Processed catches up, click Continue Scanning This Deposit. If Items Processed stops increasing, you might have lost your internet connection.

- When you are finished scanning your deposit click Capture Complete, which will indicate to the system no more items will be presented for the current batch. The option Continue Processing This Deposit allows you to correct exceptions or look at items in your deposit. You must click Capture Complete before you can balance the batch.

- IMPORTANT NOTE: Deposits cannot be balanced if Capture Complete is not selected. DO NOT select Create a New Deposit in the User Actions box. This selection will suspend the current deposit and prevent you from completing the proper sequence. To create another deposit, select Deposit Capture.

- Verify that the last item on the screen matches the last item in the scanner pocket and that the item number sprayed by your scanner is legible if applicable. Now you are ready to correct exceptions, balance, or create another deposit.

- Clip or band the deposit together with the Deposit ID noted in front. Place processed deposit face down in a process complete bin or box. Storing the processed deposits in an orderly way will prevent accidental rescanning and make research easier. Processed deposits should be retained for at least 90 days in case there are issues with your deposit.

Troubleshooting

If an Item Jams

The scanner will stop, and a message will appear.

- Remove the items from the exit pocket and turn face down.

- Remove the items from the feeder and place face up next to the scanner.

- Follow the steps in the jam message (also listed below) and read before clicking OK.

- Verify last item imaged before restarting the scanner.

- Click OK to acknowledge error message.

- The User Action Box will appear – click Cancel to show the last image uploaded to image file.

- Take ALL items that were scanned behind the last item that is displayed on the screen.

- Continue scanning batch.

- It is very important that you verify the last item that made it into the image file. Not verifying the last item will result in the transaction being out of balance.

- Clicking OK may clear any items jammed in the scanner. (If the scanner doesn’t clear, you must manually remove the items making sure not to damage the documents or the scanner.)

- Do not assume that an item was captured because it is endorsed.

- Place uncaptured items in front of the items removed from the feeder.

- Return the items to the feeder and click Scan.

Processing Exceptions

Click the Fix Errors button. This will take you to the first item to be corrected for either a MICR exception or an image quality assessment (IQA) exception. The software will guide you through each field to be corrected. Exceptions will be cleared from the screen as they are resolved. When all MICR and IQA exceptions are resolved, the software will check duplicate exceptions and present them on the Exceptions tab as well.

Procedures for Handling MICR, IQA, and Duplicate Exceptions

MICR Exceptions

The cursor will move to each field requiring correction, which will be highlighted in PINK. At the top of the screen, there will be an accompanying error message in RED. Key the missing or incomplete value according to what you see in the document.

If you cannot read the document, click the image to enlarge it. Click the image again to re-size it.

HINT: You do not need to enter the decimal in the amount field.

If you need to enter or correct data in a field that is not highlighted, use the following hotkeys to move to the desired field:

- F1 = Amount

- F2 = TC (this field is for trancode or personal check number)

- F3= Account

- F4= Field 4 (this is an alternate position for a 4-digit check number, positioned between Account & TR)

- F5= Transit Routing

- F6= RIC (just left of the TR if present; for return item & /RD use; blank the field when not present on document)

- F7= Serial (this field is for the check number on business checks)

IQA Exceptions

If an item fails Image Quality Assessment tests, it will be flagged with an X in the Image Quality column. Review the image to determine if it needs to be rescanned or is acceptable.

For each IQA exception, take one of the following actions:

- Accept the image: If the image is completely legible, click Accept Image.

- Rescan the image: If the image needs to be improved (e.g., if it is crooked or upside down), place the check in the scanner and click Rescan. You will receive a warning: “Do you want to rescan image for selected item?” Click Yes.

- The MICR will be compared with the original check. If there is a difference, you will receive a warning message. If you are certain you are rescanning the correct check, select Yes.

- Sometimes rescanning will not improve the image and it will continue to be flagged as an IQA exception. If all of the important information is legible click Accept Image.

- If the image can’t be improved and is still bad:

- Try making a photocopy, cutting the copy out, and scanning the copy. (When you are finished, staple the copy to the original for storage.)

- If everything is legible except the amount (e.g. postal money orders), handwrite the amount on the check in a blank area, then click Rescan and then Accept Image.

- Delete the image: If the image is illegible, verify that the image displayed is the item you want to delete.

- Click Delete Item and physically remove the item from the deposit. Deleted checks remain visible but the data is grayed out.

- Take any deleted checks to The Bank of Glen Burnie for deposit.

If an Item Piggybacks

If you discover that two checks ran through the scanner together (“piggyback”), find the checks in the scanner exit pocket, delete the piggyback record, and scan these checks at the end of the deposit.

Duplicate Exceptions

When all exceptions are corrected, the software will check for duplicates. If any are found, they will be flagged in the Duplicate column on the Exceptions tab. A Duplicates tab will also appear to the right of the Exceptions tab.

Click the Duplicates tab at the top of the screen. This will display the images suspected to be duplicates side by side with the current item on the left and the previously scanned item on the right. Data pertaining to the previously scanned item will be displayed beneath the two images.

If multiple suspected duplicates are found, page through the previously scanned items using the blue arrow buttons.

Once you determine whether the item is a duplicate, click Delete Item or Accept Duplicate. Please note that you must click the Duplicates tab for each duplicate found.

If no duplicates were found, or when all duplicates are resolved, the batch is ready to be balanced.

Important Note:

The following items cannot be processed electronically. These items will create exceptions:

- Savings Bonds

- Canadian US Dollar Items

- Foreign Items

- Non-Imageable Item (Checks that are not legible, too dark, or too light)

You will need to remove these from your deposit and take them to The Bank of Glen Burnie.

Balancing Deposits

After all exceptions are approved, verify totals in the Deposit Information Box.

- If your difference is zero, you can submit your deposit, create a new deposit or log out.

- If your difference is not zero, arrow down through the deposit to verify that all checks were scanned and the amounts captured were correct.

- If necessary:

- scan missing items at the end of the deposit

- fix any amounts that are incorrect

- delete unintended items, if any

- If necessary:

- If all check records are correct and the deposit is still out of balance, then adjust the deposit amount to match the total of the checks.

- When the deposit is in balance, you have the following options:

- Submit the deposit if required

- Logout and close the browser window

- Create another deposit by clicking on Capture Deposit

- Query/Deposit Report to review the deposit(s) you scanned today

REMEMBER: Always log out between user sessions!

To query for items previously processed

- Click the View Items tab.

- Click Item Query.

- Click the down arrow to enter the search criteria.

- Click Search.

- NOTE: Click Include Deletes if desired. Include a Deposit ID or one MICR field in the search criteria.

- To return to current date, click Deposit Status Query.

To search for previous days/batches processed

- Enter search criteria in Search Options, click Search.

- NOTE: Click Include Deletes if desired.

- To return to current date, click Clear and then Search.

Reports

On the Deposit Status screen, select Reports and choose from:

- Generate PDF Report

- Generate CSV Report (Excel Format)

- Deposit Detail Report

Please print a copy of the deposit report and attach it to the checks processed.

Deposit Status Definitions

Open – A deposit is placed in Open status when the deposit is newly created when a capture operator has reopened a deposit to add additional items or to resolve exceptions.

Uploading – A deposit that is in the process of uploading items.

Suspended – A deposit will remain suspended if the operator selects Cancel instead of Capture Complete. Exceptions can be repaired. Balancing cannot be performed.

Capture Complete – This is a deposit that the operator has marked as complete to notify that it is ready for repair and balancing.

In Use – This is a deposit that is in use by your bank or another operator. No actions are allowed on this deposit while in use.

Ready for Approval – This deposit has all exceptions repaired and is ready to submit.

Pending Review – This deposit has been sent for final review.

Under Review – This deposit is currently going through final review.

Submitted – This deposit is approved and ready for processing. No further actions will be allowed on this deposit.

Delivered – This deposit has been delivered for processing.